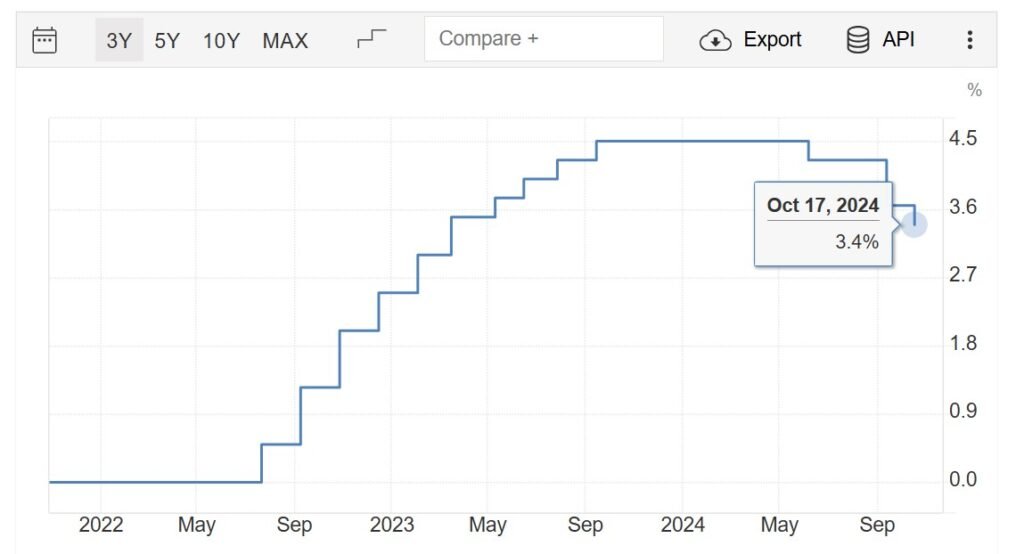

Mortgage interest rates in Portugal have been high in 2024. These rates have dropped to around 3.4% in October 2024. It has impacted Portuguese homebuyers who are now paying more to finance their homes. Portugal interest rates have been very unstable over the past year. But recent data shows that they are currently stable at around 3.4% which is slightly higher than the average for the Eurozone. However decisions made by the European Central Bank (ECB) and ongoing global economic pressures will still have a big impact on the future of real estate in Portugal.

Read More About: Education Minister Introduced “More Classes, More Success” Plan Due To Teacher Shortage in Portugal

Mortgage Interest Rates In Portugal

The European Central Bank (ECB) raised interest rates several times in past years. The goal was to reduce inflation in the Eurozone which has affected mortgage rates in Portugal. Because most Portuguese mortgages are linked to Euribor rates which react to changes in ECB rates.

Portuguese borrowers have felt these increases. Portuguese mortgage holders are paying more for new loans with rates close to 3.4 percent than those in many other Eurozone countries where the average sits at about 3.2%.

High Rates Impact On Portuguese Homeowners

The high interest rates in Portugal are largely because of a strong tradition of variable loan rates. These rates are directly influenced by the ECB’s policies. Portuguese borrowers tend to experience rapid changes in mortgage costs.

Many households are choosing mixed rate loans to help stabilize these expenses. These start with a fixed rate that gives borrowers protection from rate increases early on and then switch to a variable rate.

Housing demand in Portugal is also influencing rates. Both Portuguese residents and international buyers have been active in the market especially in regions like Lisbon and the Algarve. High demand has driven up home prices which combined with high interest rate that makes mortgages more expensive overall.

Many Portuguese households are now facing higher mortgage payments. Monthly payments for variable rate mortgages which are common in Portugal, have risen significantly over the last year.

This has led to tighter budgets for families who already had financial concerns. Even with mixed rate mortgages helping to soften these increases the cost of financing a home is high by historical standards.

Influence on Portugal’s Housing Market

These high rates are cooling the housing market somewhat. Domestic buyers are more cautious and high borrowing costs are slowing the growth of real estate. However, the impact is softened by the steady interest from foreign buyers. Portugal remains an attractive place to live and invest and this demand helps sustain the market even as rates remain elevated.

The future of mortgage interest rates in Portugal depends largely on the ECB’s next steps. If inflation starts to fall then the ECB will slow its rate hikes or even stabilize them which can allow mortgage rates to settle or decrease. For now, rates stay high until the ECB sees lower inflation across the Eurozone.

For now, Portuguese borrowers need to plan for higher payments. Options like refinancing into fixed or mixed-rate mortgages are worth considering. The government may also continue with programs that provide some relief for borrowers which will help to ease the impact of high rates.

Managing High Mortgage Costs

There are ways to help manage the high interest rate for mortgages. Homeowners with variable-rate mortgages want to look into refinancing options to take advantage of fixed or mixed rates. Budgeting carefully for rate changes especially for those with variable rates can make the adjustments more manageable.

Some government programs have offered support such as limiting the maximum interest rate increase for variable-rate mortgages. These programs aim to help homeowners adjust to rising costs. Homeowners can also consider shorter loan terms which have higher monthly payments but have less interest in the long run.

The high interest rates are not affecting just the housing market. With higher mortgage payments, households have less money for other expenses. This can reduce consumer spending which affects the economy.

Additionally, a slowdown in housing construction and sales can impact jobs in real estate and related fields. High mortgage costs may also impact younger residents, who may delay buying homes or choose to rent longer.