It’s crucial to have clear, documented contracts that define the rights and obligations of both parties. Taxes are extremely advanced, so we might not have been able to answer your query in the article. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll make sure to provide you with a strong, bespoke reply to no matter tax problems you may have.

Binary Stream points out that correct income recognition is essential for presenting a company’s true financial well being. It affects key areas like securing loans, attracting traders, and calculating taxes. This highlights the need for companies to stick to requirements like ASC 606, which provides a structured method to recognizing income over time.

Monthly Recurring Income (mrr) Explained

- The reverse of deferred income is income that has been earned however has yet to be acquired.

- Operating a business is demanding, and preserving observe of your funds could be a endless chore.

- By embracing these ideas and staying adaptable, you will be well-positioned to thrive within the subscription financial system of tomorrow.

- By implementing these steps, you may create a stable foundation for correct, compliant, and insightful subscription income accounting practices.

If a buyer pays $1,200 upfront for an annual subscription, you shouldn’t recognize all that income immediately. As A Substitute, you’d acknowledge $100 each month over 12 months to match the service supply timeline. This method, called the accrual method, precisely reflects the revenue earned during every accounting interval.

Use Expertise To Streamline The Process

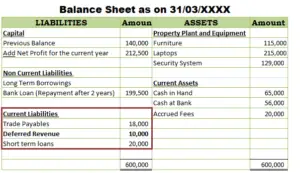

Deferred revenue is money received from clients for services not but delivered. It Is recorded as a liability on the balance sheet till the service is supplied, at which point it becomes recognized income. As subscription fashions proceed to evolve, so too will the practices surrounding their monetary administration. The future of subscription income accounting guarantees each challenges and alternatives for businesses willing to stay ahead of the curve. ASC 606 is the U.S. normal for revenue recognition, while IFRS 15 is its worldwide counterpart.

If the company completes 25% of the project within the first 12 months, they acknowledge $250,000 in income. A efficiency obligation is a promise to ship a specific good or service to the customer. It Is considered “distinct” if the client can profit from it independently or with other available assets. For instance, selling software program with setup providers represents two distinct obligations. Accrual accounting, a cornerstone of financial accounting, dictates that revenue must be acknowledged when earned, not when payment is acquired. Deferred income is a main instance of this principle, emphasizing the necessity to match revenue with the period by which it’s earned.

Precisely categorizing these prices is crucial for a transparent understanding of your profitability and for making knowledgeable https://www.intuit-payroll.org/ enterprise decisions. For complex subscription companies, a service like HubiFi can automate this process. When clients cancel subscriptions, companies should reverse income recognition appropriately to mirror the misplaced income.

Invoicing software program can automate this course of, ensuring well timed and consistent billing. Effective management of billing and cost buildings for subscription-based digital products or services is pivotal to streamline financial operations. This entails mechanisms for recurring billing, tracking invoices and funds, and dealing with discounts and customizations. With the revenue recognition JE’s full, we now flip to cash accounting. To steadiness, we’ll credit score a legal responsibility account referred to as Prepayment to track credit given out to prospects. The accounting for subscription revenues poses a challenge to new companies.

ASC 606 typically requires extra detailed disclosures, so you will need to be prepared to offer more granular information about your income streams. Accurate revenue reporting is essential for attracting traders and securing loans. Understanding the potential impression in your financial statements is crucial for easy implementation. This process accurately displays the earning of revenue over the subscription time period. This part details the method and circumstances underneath which deferred revenue transforms into recognized revenue, specializing in fulfilling the underlying service or product supply.

This can get complicated when coping with high volumes of transactions or long-term contracts. Correctly managing deferred revenue ensures compliance with requirements like ASC 606 and provides a clear picture of your monetary health. Another major problem is ensuring that income is acknowledged in the correct accounting interval. For instance, if a buyer pays $1,200 upfront for an annual subscription, you should not recognize all that revenue instantly. As A Substitute, you’d recognize $100 each month over 12 months to match the service supply timeline.

It also provides stakeholders a transparent understanding of the corporate’s obligations and the tempo at which it is fulfilling them. This methodical method to revenue recognition is not just a compliance measure however a strategic device for financial stability and transparency. Deferred income accounting is a critical idea for businesses that operate on a subscription-based mannequin.